Value of Dare’s property tax base increases by 26 percent overall

Published 4:16 pm Friday, February 28, 2020

- Courtesy Dare County

|

Getting your Trinity Audio player ready...

|

Countywide results of the 2020 property revaluation were delivered to the Dare County Board of Commissioners on Tuesday, Feb. 18, 2020.

The value of the county’s property tax base increased by an overall 26 percent to $15.92 billion.

State law requires counties to revalue property every eight years. Dare’s commissioners opted for seven years. An annual average percentage increase in value over seven years is 3.7%.

This is a preliminary report as an appeals process must be completed.

This increase is not a property tax increase. By law, the Dare County commissioners must publish a revenue neutral tax rate in revaluation years. A revenue neutral rate produces no new revenue for the upcoming fiscal year. The county commissioners will determine the tax rate during the budget process now underway. Tax rates for incorporated towns are determined by the governing board of each town.

To arrive at a fair market value for each property, Dare County uses a sales comparison approach. Real property assessors from the county’s Tax Appraisal/Revaluation Office visited each of the 41,343 parcels in the county and compared four years of close-by property sales transactions and used the adopted Schedule of Values, Standards and Rules.

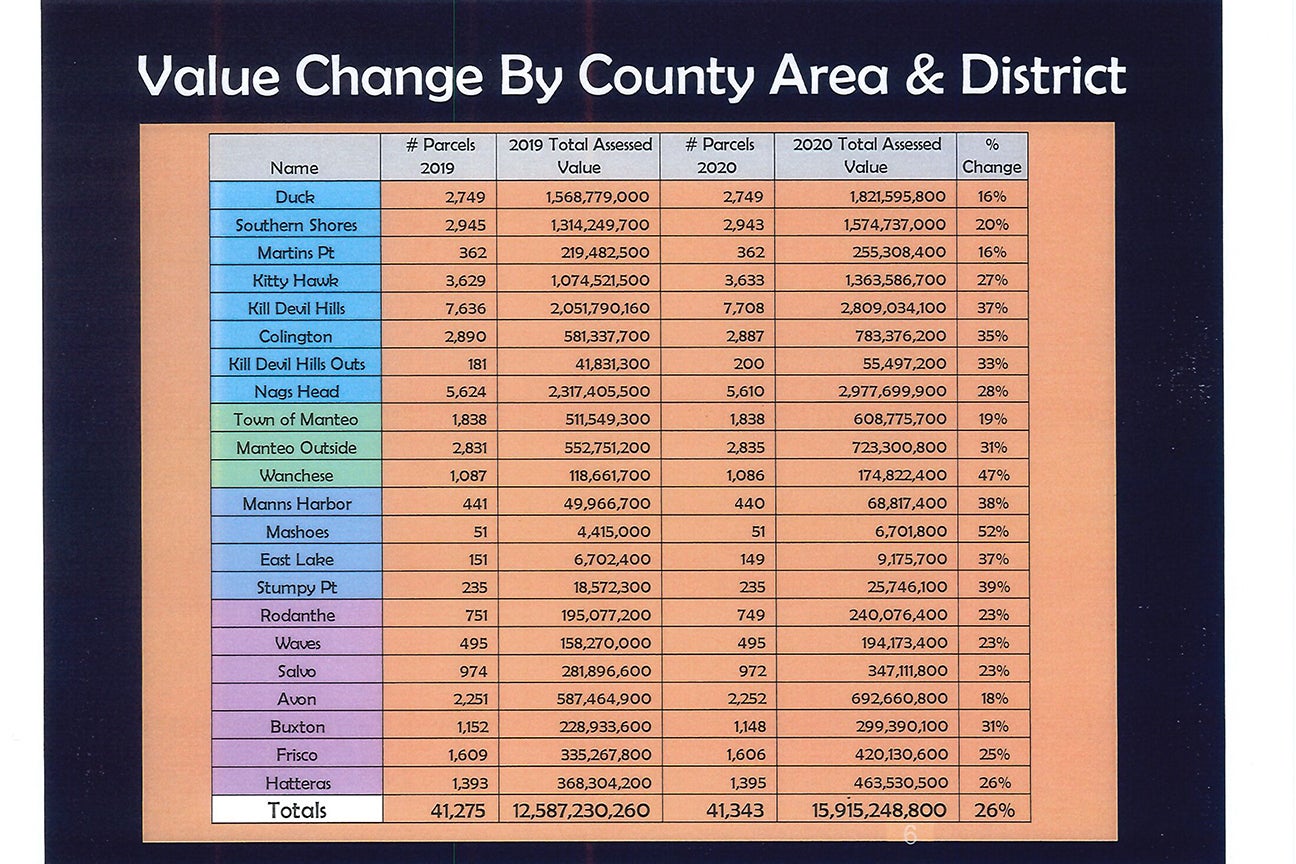

The percentage increase varies among the 21 county districts.

The lowest percentage increases are 16% in Duck and Martin’s Point, followed by Avon with 18% and Manteo (town) with 19%.

The highest percentage increases are found in Mashoes at 52%, Wanchese at 47%, Stumpy Point at 39%, Manns Harbor at 38%, Kill Devil Hills and East Lake at 37% and Colington at 35%.

With the report to the Dare commissioners finished, 2020 Notices of Assessed Value were mailed to each property owner on Feb. 25, 2020. Then an appeals process starts. An appeal of the new assessment may be launched for the following reasons: assessed value is significantly higher or lower that actual fair market value, or is based on inaccurate data, or is not equitable when compared to similar properties.

An appeal must be received by mail, electronically or in-person by the tax assessor’s office by Tuesday, March 17, 2020.

Some 45% of those Notices of Assessed Value will be mailed to property owners in Dare County; 26% to property owners in Virginia; 9% to owners in other North Carolina counties; and 20% from all 50 states and numerous foreign countries.

Overall, 15% or 2,116 parcels, are tax exempt.

Types of property in the tax base are: residential (improved or vacant) 35,749 parcels with average value of $373,300; condos and townhouses 2,879 parcels with average value of $284,200; timeshares and co-ownership 723 units/156 parcels with average value of $132,800; commercial 2,144 parcels with average value of $762,500; and boat slips 415 parcels with average value of 48,800.

Land types used in the valuation are oceanfront, sound/canal, commercial, ocean-influence, non-influenced (not-influenced by proximity to water).

Percentage increases in value among land types are: oceanfront 8,795 parcels, 28%; sound/canal, 6,551 parcels, 22%; commercial 1,767 parcels, 24%; ocean influence 8,795 parcels, 21%; non-influenced 21,086 parcels, 33%.

Vacant land is valued at $710 million and is 4% of the overall value. Hosea Wilson, Assistant County Assessor, told the commissioners that the county is obviously running out of raw land.

The new valuation used 4,914 property sales gathered from 2016 through 2019.

One of the purposes of revaluation is to “reestablish equity in the tax base among like properties.”

As of Jan. 1, 2020, the average assessed value to sale ratio for all residential properties is 99.6%; for single family 99.3%; for condos 99.9%; for commercial 97.2%; and for boat slips 1.02%.

Dare County has established a revaluation page on its website. Go to darenc.com/2020revaluation. The web page has complete details on the informal and formal appeals process and additional information.

READ ABOUT MORE NEWS AND EVENTS HERE.

RECENT HEADLINES: