Social Security Matters: Ask Rusty – Claiming Social Security now to preserve savings

Published 8:16 am Tuesday, April 6, 2021

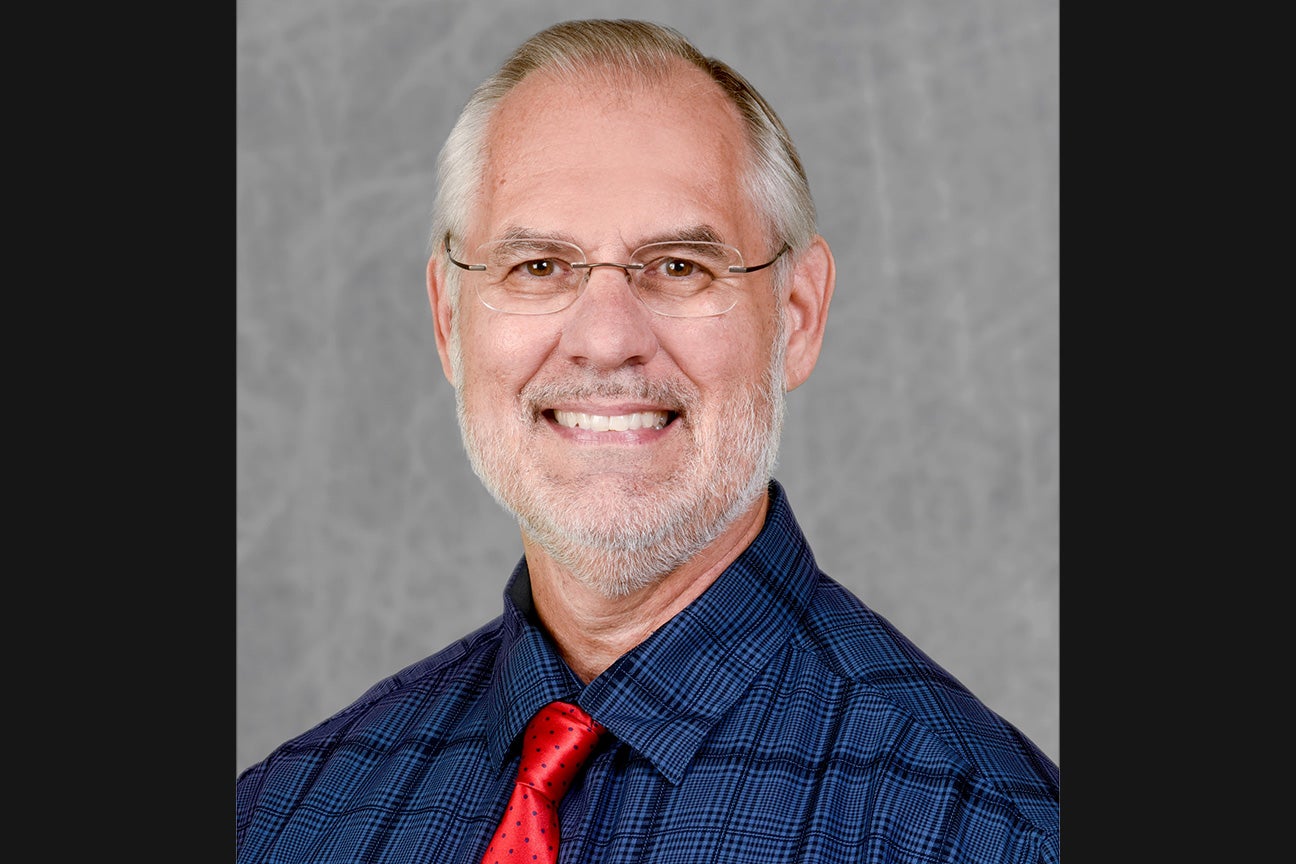

- AMAC Certified Social Security Advisor Russell Gloor, Association of Mature American Citizens

|

Getting your Trinity Audio player ready...

|

By AMAC Certified Social Security Advisor Russell Gloor, Association of Mature American Citizens

Dear Rusty: One of the big pieces of the Social Security puzzle that everyone seems to miss is the protection of other retirement funds. If I did not take SS, I would have to dip into my retirement savings to fund the early part of my retirement. I took SS at my full retirement age rather than wait, so I am preserving my retirement account that has historically been getting 8-9% interest over the last 30 years. Social Security will never give me anything close to those returns. Signed: Smart Investor

Dear Smart Investor: You are, of course, correct that preservation of retirement savings is important. It’s also correct that everyone’s personal financial situation is different. If your retirement nest egg has historically provided a return of 8-9% over the last 30 years and will continue to do so, then I believe you made the right choice by claiming at your full retirement age (FRA) and preserving those high-return investments. But many are not as fortunate as you and have their nest egg sitting in low interest IRAs and bank savings accounts, and those folks may have a different perspective. They may choose an option to delay claiming Social Security to get a higher monthly benefit, initially using some of their low-return savings but allowing them to preserve their overall savings much further into their retirement because of a higher SS benefit. And most often, continuing to work provides them added ability to delay claiming Social Security to get that higher benefit.

Personally, I do not advocate withdrawing from retirement funds in lieu of claiming Social Security. But I do suggest that waiting past FRA to claim a higher benefit may be wiser than claiming earlier and investing the SS money, trying to beat the 8% yearly benefit growth realized by waiting to claim. It’s an unfortunate reality that high-return/low-risk investments are very difficult to find these days, and most seniors are loath to put their money in high-risk investments to get higher returns.

Again, everyone’s situation is different, and each must choose based upon their own circumstances. Many who contact us about their Social Security options intend to continue working beyond their full retirement age. Those folks might adopt a strategy where they delay past their FRA to get a higher SS benefit for the rest of their life, made possible because they are still working and earning (rather than withdrawing from investments). If they’re in good health and will achieve at least average life expectancy, they will not only enjoy a much higher monthly benefit, but they’ll also receive more in cumulative lifetime benefits by waiting longer to claim Social Security.

Finally, often lost in the argument to claim at or after FRA is that, for a married couple, a surviving spouse receives 100% of the benefit the deceased spouse was receiving at death. That surviving spouse benefit will either be a smaller FRA amount or a larger (e.g., age 70) amount, depending upon when the higher earning spouse claimed. Point is, if you are married, when you claim may also affect your spouse’s survivor benefit, so life expectancy of both spouses should always be included in the decision on when to claim. In any case, from what you’ve written I believe that your choice to claim at your FRA in order to preserve your high-return investments was a prudent move for your personal circumstances. And I admire the careful thought you put into that decision.

FOR MORE COLUMNS AND LETTERS TO THE EDITOR, CHECK OUT OUR OPINION SECTION HERE.