NCDOI: Don’t let hurricane season catch you off guard

Published 6:35 am Thursday, June 10, 2021

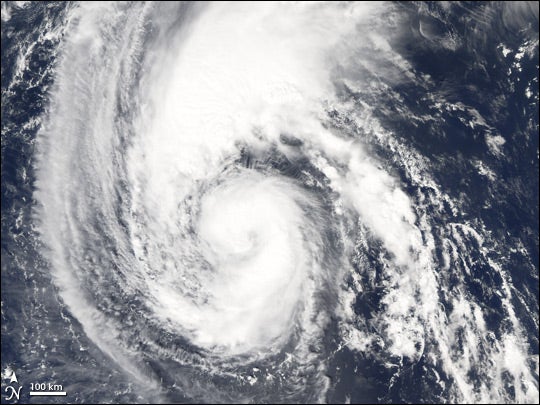

- Hurricane Florence, NOAA satellite image

|

Getting your Trinity Audio player ready...

|

June 1 marked the start of the 2021 Atlantic hurricane season. According to the National Oceanic and Atmospheric Administration, or NOAA, it is forecast to be an above-normal season. NOAA estimates 13 to 20 named storms (winds of 39 mph or higher) with six to 10 of them predicted to be hurricanes (winds of 74 mph or higher).

North Carolina and the entire southeast region bear the brunt of many of these storms. That’s why North Carolina Insurance Commissioner Mike Causey urges residents to prepare now and arm yourself with knowledge, so you’ll know what to do during and after the storm to mitigate any damages.

“These storms are powerful – precious lives and property can be spared if you take the time now, before the wind and rain hit, to protect your valuables,” said Causey.

Here are tips to help residents prepare for inclement weather that often accompanies hurricane season:

BEFORE

- Make sure you have adequate insurance coverage. Know exactly what your insurance policy covers. Homeowners’ policies do not cover flooding. At this time, you can only purchase flood insurance through the National Flood Insurance Program. Be aware there is a 30-day waiting period before flood policies take effect. If you live in a rental property, your landlord’s insurance only covers the building. None of your personal belongings are insured unless you purchase your own renters’ policy.

- Compile important documents. Gather important paperwork, including insurance policies, medical records and prescriptions. Be prepared to bring copies with you if you are forced to evacuate your home. Know how to get in touch with your insurance agent and company.

- Create a home inventory. Go room to room in your home and write down the brand name, description, estimated value and date of purchase of items in your home. It is also helpful to compile receipts, appraisal documents and serial numbers. Take videos or photographs of your belongings. Store your home inventory and related documents in a safe, easily accessible place online, on your smartphone, on your computer or in a fire-proof box or safe deposit box.

- Identify potential hazards around your home. Hanging tree branches, loose shingles, patio furniture and other outdoor objects can cause damage or injuries in a storm. Make repairs or secure large objects to reduce the threat.

- Check your emergency toolkit and to-go bag. Update items such as food, medicine and batteries.

- Electricity may go out, so make sure you have extra drinking water. Also, fill the bathtub with water for bathing and flushing the toilet.

DURING

- Shelter in place if officials advise it.

- Stay away from windows, glass doors and skylights.

- Find a safe place to stay in the interior of the home on a lower floor, unless flooding is a possibility.

- Do not use a landline if lightning is present. Make sure your cell phone is charged.

- Turn off the electricity at the main breaker if flooding becomes a threat.

- Remain indoors until officials give notice that it is safe to go outside.

- If officials order an evacuation, do not come home until officials advise it is safe to do so.

AFTER

Whether you have sheltered in place or evacuated, facing storm damage to your home can be devastating. If your home is uninhabitable, you may need to seek temporary shelter.

Here are some things you should do immediately after the storm:

- Contact your homeowners’ insurance agent or company to report the loss. Even if you have a separate windstorm or hail policy in addition to your homeowners’ policy, your primary homeowners’ insurer will investigate and adjust the claim even if you have wind or hail loss. Be patient as the insurer will likely be dealing with many claims.

- Make a list of the damages and take clear pictures before you make any temporary repairs.

- Do what you can to stop further damage from happening. For instance, place a tarp on your roof to prevent water from coming into the house. Keep receipts because your reasonable expenses to protect your property are part of the loss and may be reimbursed by your insurance company.

- Do not make permanent repairs until your insurance company has inspected the damage and you have agreed on the cost of the repairs. Check with your insurance company before you dispose of damaged materials or items.

- If your home is inhabitable, check with your insurance company to determine which expenses will be reimbursed.

For more information on how to be prepared before, during and after any storm, contact the North Carolina Department of Insurance Consumer Division at 1-855-408-1212.

READ ABOUT MORE NEWS AND EVENTS HERE.

RECENT HEADLINES:

Cape Hatteras National Seashore beach cleanups set for Saturday

Dare commissioners pursue projects for workforce and essential housing