Social Security Matters: Ask Rusty – What’s the best way to start receiving my survivor benefit?

Published 1:27 pm Thursday, March 30, 2023

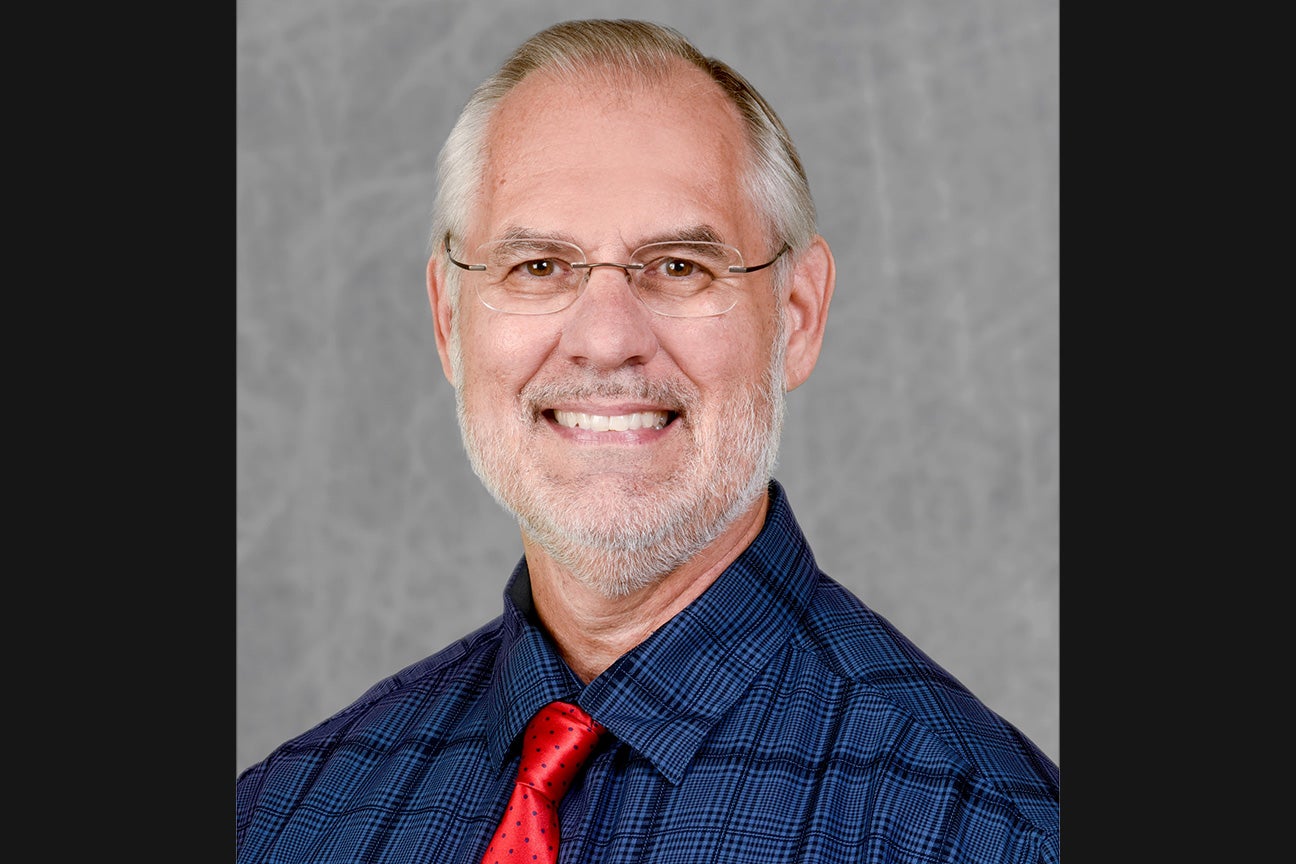

- AMAC Certified Social Security Advisor Russell Gloor, Association of Mature American Citizens

|

Getting your Trinity Audio player ready...

|

By AMAC Certified Social Security Advisor Russell Gloor, Association of Mature American Citizens

Dear Rusty: When one becomes a widow/widower, what is the most efficient way to start receiving the deceased’s monthly Social Security? Signed: Still Grieving

Dear Still Grieving: There is really only one way to start receiving surviving spouse benefits – you must contact Social Security directly to apply. You can call 1-800-772-1213 or call your local Social Security field office (find the number at ssa.gov/locator) to make an appointment to apply for your survivor benefits. These appointments are normally conducted over the phone, so a personal visit to the Social Security office isn’t usually necessary.

The larger question to consider is when you should claim the survivor benefit. Like most other Social Security benefits, your age when you claim determines how much your survivor benefit will be. And a survivor benefit isn’t payable in all cases. Consider these points:

- If the surviving spouse is already receiving their own Social Security retirement benefit and that is more than the deceased spouse was receiving, the surviving spouse continues to receive only their own higher benefit but will get a one-time lump sum death benefit of $255.

- If the surviving spouse’s own benefit is less than the deceased was receiving, the surviving spouse’s benefit will be based on the higher amount.

- If the surviving spouse has reached their full retirement age (FRA), the survivor’s benefit will be 100% of the amount the deceased was receiving. If the widow(er) has not yet reached their FRA when they claim their survivor benefit, the amount will be reduced (by 4.75% for each full year earlier than FRA).

- A survivor benefit reaches maximum at the survivor’s FRA. If the surviving spouse hasn’t yet reached FRA, they have the option to delay claiming their survivor benefit until it reaches maximum at their FRA. There is one exception to this: if the surviving spouse was already receiving only a spousal benefit from the deceased (and not their own Social Security retirement benefit), the survivor benefit will be automatically awarded regardless of the survivor’s age.

- If the surviving spouse hasn’t yet claimed their own Social Security retirement benefit, they have the option to claim only their survivor benefit first and permit their personal Social Security retirement benefit to grow (up to age 70). That would be prudent if the survivor’s own Social Security retirement benefit at age 70 will be higher than their maximum survivor benefit at their full retirement age.

- If you haven’t yet reached your full retirement age and are still working, Social Security has an earnings test which limits how much you can earn before some benefits are taken away. The limit for 2023 is $21,240 and if that is exceeded, they will take away benefits equal to $1 for every $2 you are over the limit. The earnings test goes away when you reach your FRA.

So, as you can see, there are several things to consider as you decide when to claim your Social Security benefits as a widow or widower. I hope the above information helps you make an informed choice.

SUBSCRIBE TO THE COASTLAND TIMES TODAY!