Homeowners’ insurance going up; settlement reached

Published 11:36 am Sunday, April 22, 2018

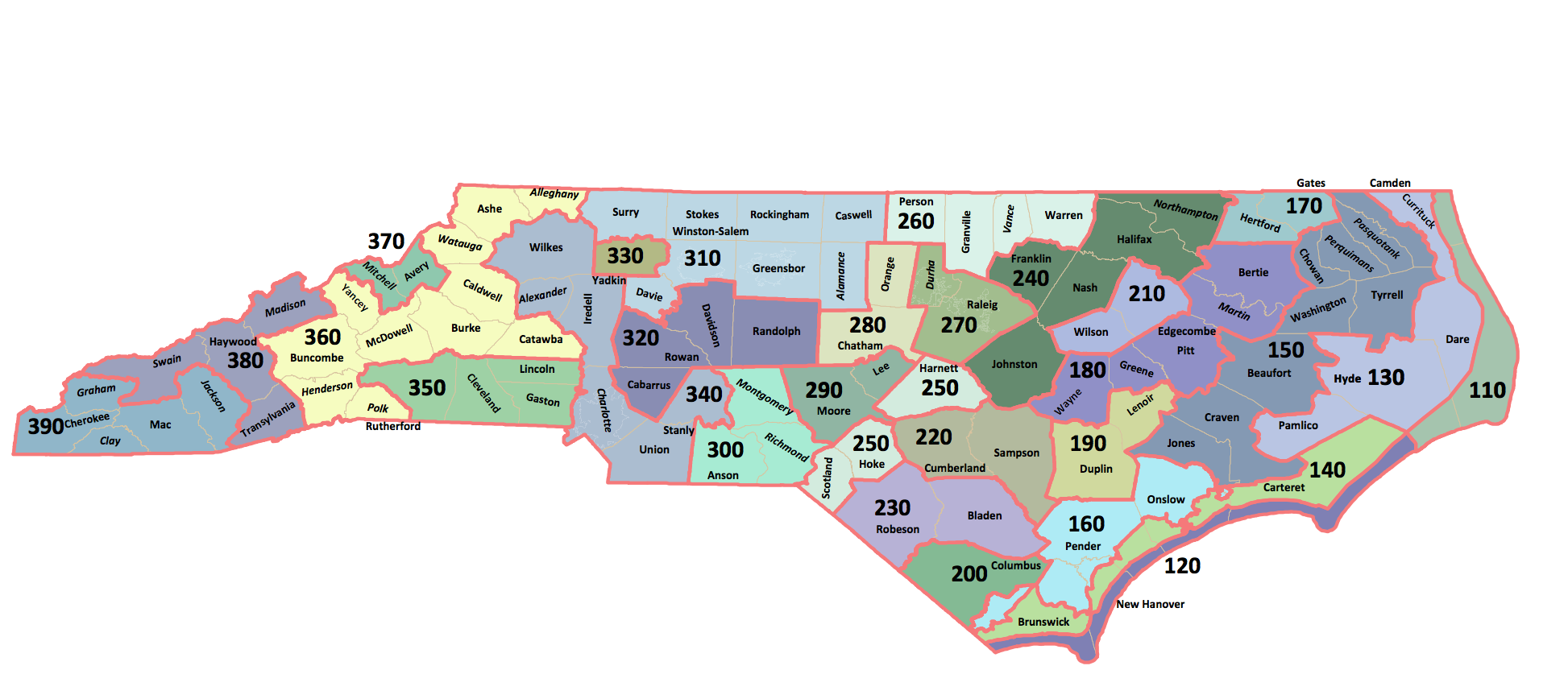

- Insurance territories across NC HOMEOWNER insurance rates are going up Oct. 1. For the coastal and mainland areas of the Outer Banks, territories 110 and 130, the rate will go up 5.5 percent. Four territories (150, 170, 350, 360) have increases between 1.5-5.4 percent. Four territories other territories (300, 370, 380, 390) have reductions varying between 6.1 to 9.4 percent.

Homeowner insurance rates are going up 5.5 percent in the coastal and mainland areas of northeastern North Carolina.

On April 18, a settlement agreement between the North Carolina Department of Insurance and the NC Rate Bureau was announced by Insurance Commissioner Mike Causey.

The 5.5 percent rate change is the homeowners cap imposed statewide and is applied to 21 of the 29 insurance territories in North Carolina. Four territories (#s 150, 170, 350, 360) have increases between 1.5-5.4 percent. Four territories (#s 300, 370, 380, 390) have reductions varying between 6.1 to 9.4 percent.

Statewide, the average rate increase is 4.4 percent.

Rates for renters for liability and content coverage and condominium owners will increase 12 percent across the state.

Overall, the rate increase with homeowners, renters and condo owners is 4.8 percent.

The increase will take effect Oct. 1.

Lori Brooks, President of the Outer Banks Association of REALTORS®, issued the following statement regarding the settlement agreement:

“The Outer Banks Association of REALTORS® applauds NC Insurance Commissioner Mike Causey for reaching a fair and equitable settlement with the NC Rate Bureau on homeowner policy insurance rates. The announced 5.5 percent increase for Currituck and Dare mainland and barrier island homeowner insurance policyholders is welcome news compared to the very high increase originally proposed. Our position was that the proposed 25 percent increase on homeowners and wind only policies was unwarranted and unjustified. We thank the department for their extensive review of the filing and for hearing our concerns.”

The statement continues “However, we recognize more work needs to be done” and cites a statement by 2018 NC REALTORS® President Amy Hedgecock: “It is important to take steps at both an administrative and legislative level to ensure consumers are not additionally harmed by actions like consent to rate letters distributed by companies who wanted more significant rate increases. We look forward to working with Commissioner Causey and legislative leaders over the coming months.”

Homeowners insurance covers liability and fire and sometimes wind damage. Some insurance policies exclude wind damage and the homeowner seeks a separate wind policy. Flood insurance is also a separate policy.

In territory 110, a policy covering liability, fire and wind on a $200,000 framed home in a Class 5 fire district with a $1,000 deductible would have an average base premium of $2,383, reports the Department of Insurance. In territory 130, the average base premium for the same home would be $1,516.

Initially, the rate bureau filed for a proposed 18.7 percent rate increase Nov.17, 2017, claiming the increase was necessary because of the increased costs stemming from tornado, severe thunderstorm, and windstorm/hail damage. Along the coastal and mainland Outer Banks, the rate was proposed at 25 percent, the highest rate proposed.

Causey called for a formal hearing to be held July 23, but the new settlement eliminates the need for a hearing.

“The last time homeowners saw an insurance rate increase was in 2012. At that time, the NCRB case was settled for an average statewide increase of 7 percent,” states the department’s media release.