Recommended budget for FY ’23 presented to Dare commissioners

Published 7:10 am Thursday, May 5, 2022

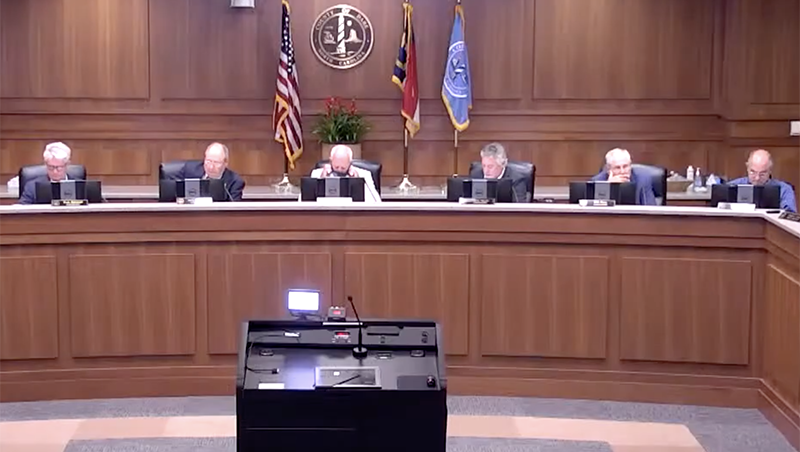

- Dare County video still

|

Getting your Trinity Audio player ready...

|

Dare County’s commissioners formally received the county manager’s recommended budget for fiscal year 2023 on May 2, 2022.

Previously, the commissioners worked on a budget preview April 25.

On May 16, the commissioners will hear from Dare Countians at a public hearing. The regularly scheduled Board of Commissioners meeting starts at 5 p.m. in the commissioners meeting room at 954 Marshall Collins Drive in Manteo.

At the May 2 meeting, county manager Robert L. Outten read his entire budget message into the record. The 16-page document includes the recommended operating budget and all the separate funds.

The General Fund, the one used for operating county government, totals $123,964,551. Funds associated with the General Fund are Capital Investment Fund, Disaster Recovery Fund and Law Enforcement Officer’s Special Separation Allowance Fund.

Special revenue funds are C&D Landfill, E911, Beach Nourishment, Social Services Foster Care, Sanitation, Inlet Maintenance, Deeds of Trust, Fines & Forfeitures and Representative Payee. The Water Fund and the Water Department’s Capital Reserve fund are considered enterprise funds.

When the general and other funds are combined, the total county budget is $213,456.649.

Outten read: “the 2023 budget assumes that the elevated activity of the prior two years presents a new normal.”

As to revenue, the property tax rate remains the same at 40.05 cents per $100 valuation. That tax rate will be applied to a 1.01% higher property value, which is now $17.085 billion. Sales taxes are predicted using the North Carolina League of Municipalities projection of 3.75% over 2022. Occupancy tax is projected to be 1.0% over the projected amount for 2022.

The 40.05 cent property tax rate is the fifth lowest in the state, said Outten.

No fire or rescue departments are raising the ad valorem tax rate.

The Sanitation Fund goes up another cent to 0.10 cents per $100 valuation. Outten said the sanitation department had been subsidizing the budget for picking up residential and commercial trash in unincorporated Dare County for years by using fund balance.

One of the top priorities in this year’s budget was making improvements in employee salaries, benefits and working environment. The budget also prepares for implementing a now-underway salary study anticipated in the fall of 2022.

The budget recommends a 5% cost of living increase for full and part-time employees at $2.22 million; a 3% employer 401k plan contribution at $1.035 million; a grade step plan to address salary compression at $698,593; a $500,000 reserve for implementing the new salary study; and changing the merit program to a one-time bonus system at $557,453.

The Capital Improvements Plan uses the county’s 65% of the local land transfer tax along with funding from the General Fund to pay for projects. Thirteen projects are recommended in Outten’s budget.

Dare County Schools receives $1.79 million for capital improvement projects in the schools and $573,805 for local capital outlay.

Other projects include purchasing state law compliant voting machines, detention center renovations and other projects.

On May 2, the commissioners received a presentation titled “Dare County Green Space Initiative” about installing turf at the fields at Satterfield behind First Flight High School.

Making the presentation were Jamie Varnell and Molly Garavito. The duo is not the first to appear at commissioners’ meeting asking for action on soccer and lacrosse fields in the beach community.

In the capital budget is $850,000 for light installation at athletic fields behind First Fight Middle and High schools.

The manager’s recommended budget for 2023 can be found here.