Dare County’s proposed 2021 budget up for consideration next week

Published 4:38 pm Friday, May 29, 2020

|

Getting your Trinity Audio player ready...

|

Dare County’s Board of Commissioners will hold a public hearing on the manager’s proposed budget for fiscal year 2021 on Monday, June 1 at 9:30 a.m.

The proposed budget is posted on the Dare County website at darenc.com/departments/finance/annual-budgets.

The commissioners meeting will be held online, with all seven commissioners in the regular meeting room in the county’s governmental complex on Roanoke Island.

Comments on the budget can be made to all commissioners by emailing dcboc@darenc.com before or during the public hearing.

Comments on the proposed budget in person will also be allowed during the public hearing.

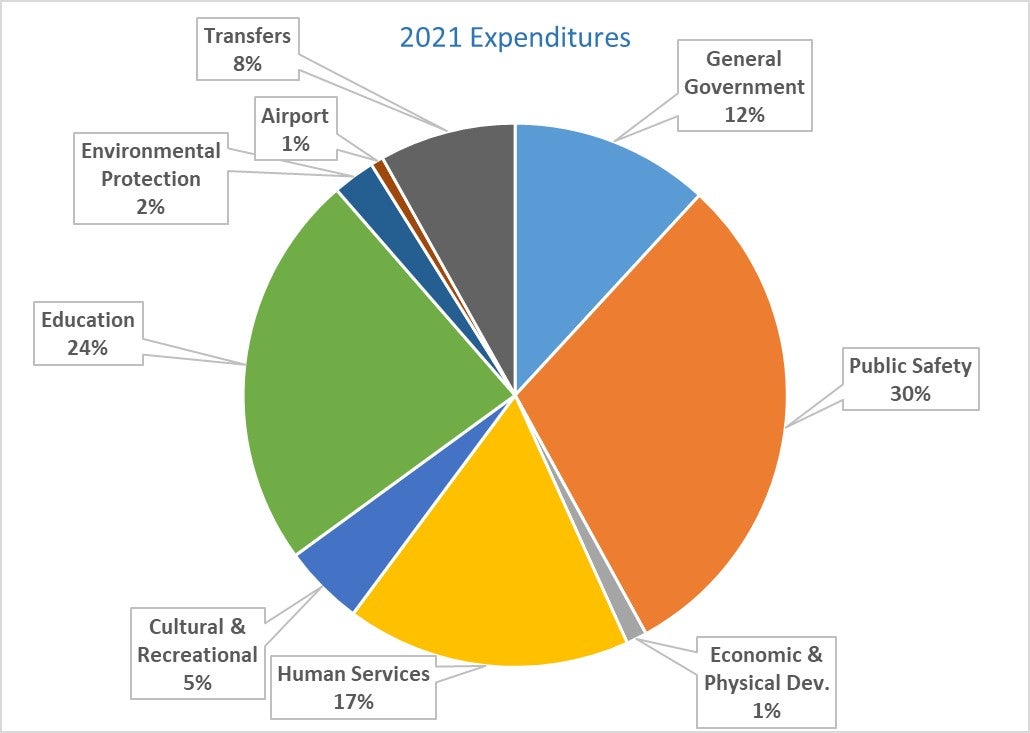

The proposed budget is austere due to the effects of COVID-19 on the county’s revenue stream. The manager’s total budget with the General Fund plus 10 separate funds declines 5.59%. The General Fund, the government’s operating fund, declines 1.53% to $107.07 million. The total budget is $159.38 million.

On Jan. 1, 2020, property revaluation went into effect for Dare County. Property value grew to $16.147 billion. Ad valorem, or property tax, revenue is expected to be $63.7 million based on a revenue neutral rate of 40.05 cents per $100 valuation. The new rate is about seven cents lower than the previous rate. This revenue stream is also calculated on a reduced collection rate of 98.5%.

Property tax receipts for 2021 are projected to be slightly higher – about $603,000 – than the amount projected for the current fiscal year. Calculating the revenue rate is set out in the North Carolina’s General Statutes. The calculation uses the current tax base to arrive at a revenue target for calculating the revenue neutral rate. Then, to account for growth in the tax base, the average annual growth is calculated from the last revaluation. For Dare, the rate is 1.076%. The additional $603,000 in revenue represents growth.

County manager Robert L. Outten states in his budget message that the first quarter of the new fiscal year sales tax revenue will decline 10% and in subsequent quarters, 2.5%. Occupancy tax revenue decreases in crucial months of July, August and September.

Expenditures are cut.

In personnel, no new positions are created. The original budget submission totaled 19 new positions at a cost of $2.17 million. The revised request shows two new positions at $127,176, but the positions are not funded.

The health plan has a 5% projected increase.

No cost of living adjustment or merit pay has been included for employees.

Regarding Dare County Schools, the budget message states “Using the school funding formula agreed upon in 2016 would have resulted in an increase of $653,470.” Instead, the Dare County budget for schools sets aside $23,230,449, the same amount as the current fiscal year for local current expense base. In addition, the county’s budget funds $1,245,639 for county-employed school nurses and school resource officers. The total allocated for school operations is $24,476,894 which includes $1,700 for utilities.

The manager’s budget calls for $295,000 in capital outlay and one new capital project for the schools.

The NC Department of Public Instruction projects a total of 5,269 students for Dare County Schools for the next fiscal year, an increase of 18 students.

For Elections, $14,000 is included for voting equipment rental and $22,000 is included for replacing laptops.

For Information Technology, $25,000 will be spent for additional network security services and training, $15,000 is included for additional Alertus software related equipment for staff security and $15,000 is included for additional software and device maintenance costs.

For the Sheriff’s budget, $208,152 is added to correctly classify sworn law enforcement officers per the Fair Labor Standards Act to 171 hours per 28 day per period.

For College of The Albemarle, the budget maintains $250,000 for local scholarships to COA, a board priority. The scholarships are for Dare County graduating seniors who wish to attend the community college. In addition, the budget contains $582,064 for operating the Dare Campus. Building the new College of The Albemarle Dare County Campus on Roanoke Island is one construction project that continues.

For the Courts, $66,100 is allocated for a security system update and security improvements at the courthouse.

Transfers to Other Funds include $210,000 transferred to the Inlet Maintenance Fund for Hatteras Inlet. This maintains the annual amount available for the county share of work performed at $250,000, states the manager’s message.

Limited capital projects are suggested in the proposed budget.

A $1.95 million reduction in the transfer of funds from the General Fund to the Capital Investment Fund sends over $8.48 million to the investment fund.

An expected decrease in land transfer taxes and restricted portions of sales tax limits capital expenditures to six:

– $150,000 for local capital outlay for Dare County Schools.

– $145,000 for the Dare County Schools Capital Improvement Plan for a HVAC chiller replacement.

– $22,000 of capital outlay for Information Technology.

– $257,282 earmarked as $196,632 for construction and repairs to the Solid Waste Transfer Station and $60,650 to rebuild a sewer lift station at the College of The Albemarle.

– $9,579 for a county HVAC replacement.

These capital expenditures total $583,861. The initial capital request was $2.12 million.

Outten also recommends adding $1 million to the planned 2020B Limited Obligation Bond debt issuance for a roof replacement at Manteo High School. “The sections of roof to be replaced were last done so in 1988 and 1998 and are in dire need of work,” states the budget message.

Financing for two capital projects gets pushed forward. EMS facilities move to 2023 and a new Public Works facility to 2025.

The county has several separate funds, some of which are noted in the budget message,

Disaster Recovery Fund. Policy states that the fund must have 1% of the General Fund budget. In 2020, $413,437 was transferred from the General Fund to the Disaster Recovery Fund. The recovery fund budgets for software recovery services and $100,000 for initial response to emergencies. This fund is part of the General Fund.

Regarding the Beach Nourishment Fund, for the 2021 budget, $144,000 is slated for sand fencing projects and $600,000 of debt service support for Nags Head (when combined with remaining amounts from the related capital project budget), $1,430,899 of debt service support for Duck, Kitty Hawk and Kill Devil Hills and $7,284,842 of county debt service payments for debt issued for projects in Buxton, Nags Head, Kill Devil Hills, Kitty Hawk and Duck, states the budget message. The budget also calls for transferring $1,735,400 from the Beach Nourishment Fund to Inlet Maintenance for Oregon Inlet Dredging. The amount represents the county’s required contribution for U.S. Army Corps of Engineers Oregon Inlet dredging project scheduled for 2021. The Beach Nourishment Fund is categorized as a Special Revenue Fund.

The budget message states “the Sanitation Fund’s property tax rate is set at the revenue neutral rate 8.86 cents. 2021 appropriates fund balance of $185,299 to balance the budget. Ending fund balance at June 30, 2020 is projected to be $2,002,307, or 36% of expenditures. The fund balance is expected to reach around 20% of expenditures at the end of 2023. Therefore, with the 2024 budget, the tax rate will have to be adjusted or significant service level reductions will have to occur.” The Sanitation Fund is categorized as a Special Revenue Fund.

The Water Fund, an entrepreneurial account, will not have a rate increase in 2021.

Outten expects that state and federal COVID-19 grants will help with the 2020 and 2021 budgets. The budget message reports that as of May 18, “the County has received a $67,354 CDC grant for Health Department costs, a CARES Act Medicare Provider grant of $235,986 for lost revenues and costs, and a COVID-19 State Relief Fund (federal funds) grant of $852,149 for costs through December 30. Additional grants for Medicare Providers and Transportation are expected.”

During the board’s consideration on May 18, commissioner Wally Overman moved to allow the county manager to use excess funds above the costs of the Recovery Court line-item for opioid mitigation, education, prevention or treatment. The motion passed unanimously. Under the manager’s business portion of the meeting, Outten let the commissioners know he would look to the county’s Substance Abuse Task Force for guidance on expenditures.

Procedures for making comments in person during the public hearing on Dare County’s proposed 2021 budget are as follows:

– One-at-a-time entry to the meeting room at 954 Marshall C. Collins Dr. in Manteo.

– Sanitize hands. A Dare County Sheriff’s Deputy will facilitate.

– Walk through detector.

– Admission for comment. State name and address before speaking.

– After exit, another person will be permitted entry.

RECENT HEADLINES:

TowneBank supports Dare County Arts Council’s digital art programs

Head of North Carolina unemployment office replaced by former legislator