Proposed homeowners insurance rate increase comments due Thursday

Published 12:06 pm Thursday, December 10, 2020

|

Getting your Trinity Audio player ready...

|

By Willo Kelly and Porter Graham

Last month, the North Carolina Rate Bureau (NCRB) submitted a Homeowners Insurance Rate Filing to the NC Department of Insurance. The filing reflects an overall statewide average increase of 24.5% for homeowners, renters’, and condominium rates. The filing affects condo, tenants as well as wind only policies.

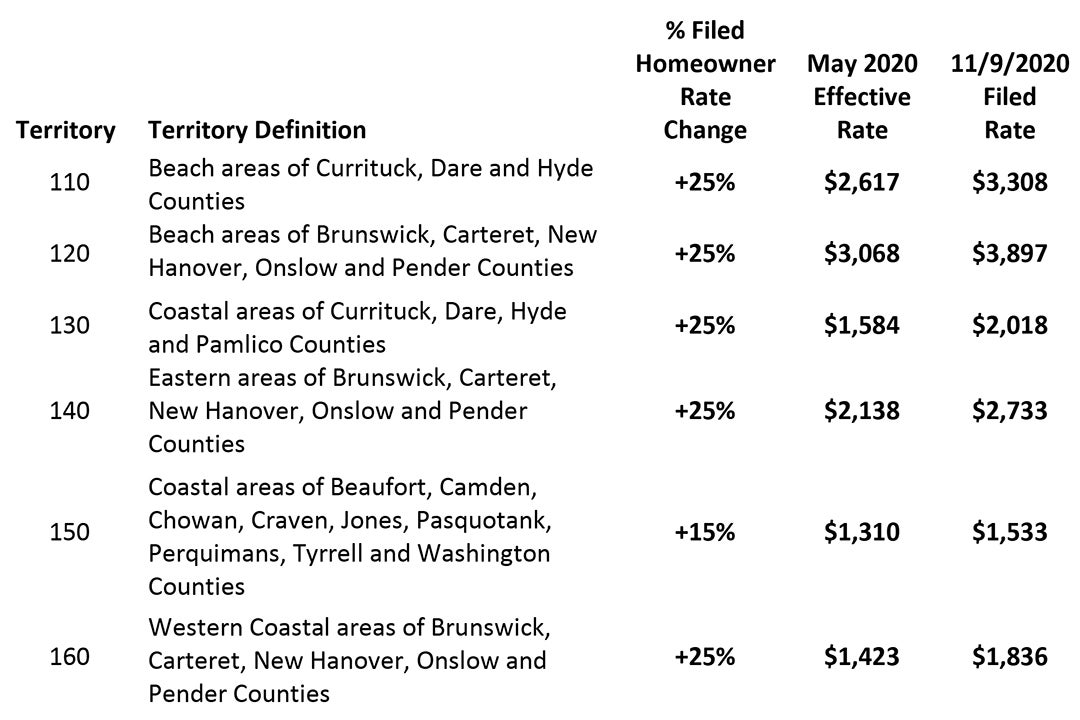

Below is a breakdown of the filed rate changes for eastern NC:

The deadline to submit comments is Thursday, December 10, 2020. Email 2020Homeowners@ncdoi.gov TODAY and request NC Department of Insurance Commissioner Mike Causey DENY the 2020 Homeowners Rate Filing.

NCDOI is holding a virtual public comment session on Thursday, December 10, from 10 a.m. to 3 p.m. accessible via the following WebEx link: https://ncgov.webex.com/ncgov/j.php?MTID=m28717b65acc9281b45e4c7bd66151e39. The hearing officer facilitating the forum will ensure that all participant comments are heard and recorded.

The Outer Banks Association of REALTORS® has examined the filing and suggest you include the following talking points in your comments via email or during the public comment period:

- The proposed rate increases are excessive, unwarranted and unjustified.

- The increase in the Homeowners Insurance rate affects year-round resident policyholders, wind only policyholders, condo and renter policyholders.

- The unwarranted increased cost of homeowners’ insurance impacts the affordability of housing and the ability of a policyholder to make their mortgage payments. This impacts families that live in our year-round neighborhoods and will be especially burdensome due to COVID-19 impacts on our communities.

- Rate increases just went into effect May 1, 2020. The potential of these rate changes to increase voluntary coastal writing is not yet known. There has not been enough time to thoroughly evaluate the adequacy of the newly effective rate increases.

- The filing does not include the number of policyholders or amounts charged over the manual rate under “consent to rate”. NC HO Policyholders paying a premium under “consent to rate” are currently paying on average statewide 31% above the manual rate per NCDOI.

- NCRB claims NCIUA, formerly known as the “Beach Plan” is “increasingly the market of first resort” in coastal North Carolina. In reality, NCIUA’s total liability exhibits a ten-year average decrease, and is down to $76.5 billion in 2019 from a 2014 high of $91 billion. Policyholders do not request to have coverage through NCIUA; they are placed with NCIUA by their carrier/agent.

- NCRB claims higher rates must be established to protect North Carolinians because “the inadequacy of the rates at the beach and coast will lead to…catastrophe recover charges on all property insurance policyholders throughout the state,” “the prospect of a Beach Plan assessment affects the willingness of a company to write in North Carolina” because “it will be subject to Beach Plan assessments for huge losses.” In reality, the exhaustion probability of NCIUA’s final reinsurance layer before a catastrophe recovery charge is 0.0010%, based on “the largest amount of modeled annual hurricane losses after blending 100,000 years of AIR and RMS modeled losses”.

- From 2013 through 2019 the Beach Plan collected approximately $2.6 Billion in premiums earned and incurred $1.6 Billion in losses with $515 million in surplus at the end of 2019.

- NCRB claims “the prospect of a Beach Plan assessment affects the willingness of a company to write in North Carolina” because “it will be subject to Beach Plan Assessments for huge losses” due to NCIUA’s overexposure to coastal hurricane risk. In reality, the majority of NCIUA’s total residential liability is for inland wind coverage less susceptible to hurricane risk than beach wind policies, which account only for about $8 billion of the total residential liability.

- The filing does not include a factor expressing variances from the manual rate due to deviations and consent to rate.

- The filing includes an “off balance factor” which causes the overall statewide average increase to be higher than 24.5%.

NCDOI has emphasized the importance of substantive public commentary on the filing to its negotiation of an appropriate compromise rate. Public comment in coastal North Carolina will be especially important on Thursday because the North Carolina Rate Bureau (NCRB) is attempting to present this year’s filing as protective of coastal homeowners and the North Carolina Insurance Underwriting Association (NCIUA). NCRB is telling the public that NCIUA is overexposed because voluntary insurers cannot compete in coastal counties due to inadequate homeowner’s insurance rates. NCRB has testified that the proposed rate increase is necessary to help NCIUA avoid a deficit event that exhausts its claims-paying capacity and triggers a statewide policyholder surcharge.

This argument is flawed. NCRB is overstating the scope and growth rate of NCIUA’s liabilities and mischaracterizing the potential of a deficit event in order to pass off their proposed rate increase as public service.

Let your voice be heard on these unfair and unsubstantiated rate increases!

READ ABOUT MORE NEWS AND EVENTS HERE.

RECENT HEADLINES:

COVID-19: Modified stay-at-home order goes into effect Friday